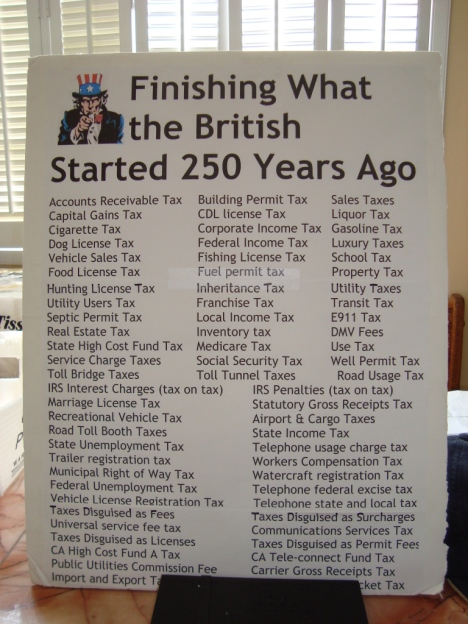

Our friends at Free Republic have a thread going that documents all the various taxes we pay.

Talk about multiple taxation. They tax our income, then with what’s left over, when we make purchases, they tax those things too. The Fair Tax would solve that problem. But I don’t see that happening with all of the pigs at the trough (in Congress)

Here’s the list, and there are others added at the thread page:

1. Accounts Receivable Tax

2. Accounting and Tax Preparation fees (cost to taxpayers $300 billion)

3. Accumulated Earnings Tax

4. Accumulation Distribution of Trusts

5. Activity Fee (Dumping Permit Fee)

6. Air Tax (PA coin-operated vacuums)

7. Aircraft Jet Fuel Tax

8. Aircraft Excise Tax

9. Alcohol Fuels Tax

10. Alcoholic Beverage Tax

11. Alternative Minimum Tax – Amt

12. Ambulance Services (Air Ambulance Services, SD)

13. Ammunition Tax

14. Amusement Tax (MA, VA, MD)

15. Annual Custodial Fees (Ira Accounts)

16. Ballast Water Management Fee (Marine Invasive Species)

17. Biodiesel Fuel Tax

18. Blueberry Tax (Maine)

19. Bribe Taxes (Pay If You Dare)

20. Brothel licensing fees (NV – $35,000.00 per year per brothel)

21. Building Permit Tax

22. Capital Gains Tax

23. California Interstate User Diesel Fuel Tax

24. California Redemption Value (Can and Bottle Tax)

25. CDL License Tax

26. Charter Boat Captain License

27. Childhood Lead Poisoning Prevention Fee

28. Cigarette Tax

29. Cigarette Tax Stamp (Acts) (Distributors)

30. Compressed Natural Gas Tax

31. Commercial Activity Tax (OH – for Service Providers)

32. Corporate Income Tax

33. Court Fines (Indirect Taxes)

34. Disposable Diapers Tax (Wisconsin)

35. Disposal Fee (Any Landfill Dumping)

36. Dog License Tax

37. Electronic Waste Recycling Fee (E-Waste)

38. Emergency Telephone User Surcharge

39. Environmental Fee (CA – HazMat Fees)

40. Estate Tax (Death Tax, to be reinstated)

41. Excise Taxes

42. Facility Fee (CA – HazMat Fees)

43. FDIC tax (insurance premium on bank deposits)

44. Federal Income Tax

45. Federal Unemployment Tax (FUTA)

46. Fiduciary Income Tax (Estates and Trusts)

47. Fishing License Tax

48. Flush Tax (MD Tax For Producing Wastewater)

49. Food License Tax

50. Fountain Soda Drink Tax (Chicago – 9%)

51. Franchise Tax

52. Fresh Fruit (CA, if Purchased From A Vending Machine)

53. Fuel Permit Tax

54. Fur Clothing Tax (MN)

55. Garbage Tax

56. Gasoline Tax (44.75 Cents Per Gallon)

57. Generation-Skipping Transfer Tax

58. Generator Fee (Recycled Waste Fee)

59. Gift Tax

60. Gross Receipts Tax

61. Hamburger Tax (Ask Huckabee)

62. Hazardous Substances Fees: Generator, Facility, Disposal

63. Household Employment Taxes

64. Hunting License Tax

65. Illegal Drug Possession (No. Carolina)

66. Inheritance Tax

67. Insect Control Hazardous Materials License

68. Insurance Premium Tax

69. Intangible Tax (Leases Of Govt. Owned Real Property)

70. Integrated Waste Management Fee

71. Interstate User Diesel Fuel Tax

72. Inventory Tax

73. IRA Rollover Tax (a transfer of IRA money)

74. IRA Early Withdrawl Tax

75. IRS Interest Charges

76. IRS Penalties (Tax On Top Of Tax)

77. Jock Tax (income earned by athletes in some states)

78. Kerosene, Distillate, & Stove Oil Taxes

79. Kiddie Tax (Child’s Earned Interest Form 8615)

80. Lead Poisoning Prevention Fee (Occupational)

81. Lease Severance Tax

82. Liquid Natural Gas Tax

83. Liquid Petroleum Gas Tax

84. Liquor Tax

85. Litigation Tax (TN Imposes Varies With the Offense)

86. LLC/PLLC Registration Tax

87. Local Income Tax

88. Lodging Taxes

89. Lump-Sum Distributions

90. Luxury Taxes

91. Make-Up Tax (Ohio, applying in a salon is taxable)

92. Marriage License Tax

93. Meal Tax

94. Medicare Tax

95. Mello-Roos Taxes (Special Taxes and Assessments)

96. Minnow Dealers License (Retail – For One Shop)

97. Minnow Dealers License (Distributor – For One+ Shops)

98. Mobile Home Ad Valorem Taxes

99. Motor Fuel Tax (For Suppliers)

100. Music and Dramatic Performing Rights Tax

101. Nudity Tax (Utah)

102. Occupation Tax (Various Professional Fees)

103. Oil and Gas Assessment Tax

104. Oil Spill Response, Prevention, And Administration Fee

105. Pass-Through Withholding

106. Pay-Phone Calls Tax (Indiana)

107. Personal Property Tax

108. Personal Holding Company (undistributed earnings)

109. Pest Control License

110. Petroleum Business Tax

111. Playing Card Tax (Al)

112. Pole Tax (TX – A $5 Cover Charge On Strip Clubs)

113. Profit from Illegal Drug Dealing

114. Property Tax

115. Prostitution Tax (NV – Prostitute Work Permits)

116. Rain Water Tax (Runoff after a Storm)

117. Real Estate Tax

118. Recreational Vehicle Tax

119. Road Usage Tax

120. Room Tax (Hotel Rooms)

121. Sales Tax (State)

122. Sales Tax (City)

123. Sales And Use Tax (Sellers Permit)

124. School Tax

125. Service Charge Tax

126. Self Employment Tax

127. Sex Sales Tax (UT, when nude people perform services)

128. Sewer & Water Tax

129. Social Security Tax

130. Sparkler and Novelties Tax (WV Sellers of Sparklers, etc.)

131. Special Assessment Tax (Not Ad Valorem)

132. State Documentary Stamp Tax on Notes (FL RE Tax)

133. State Franchise Tax

134. State Income Tax

135. State Park Fees

136. State Unemployment Tax (SUTA)

137. Straight Vegetable Oil (SVO) Fuel Tax

138. Stud Fees (Kentucky’s Thoroughbred Sex Tax)

139. Tangible Personal Property Tax

140. Tattoo Tax (AR Tax On Tattoos)

141. Telephone Federal Excise Tax

142. Telephone Federal Universal Service Fee Tax

143. Telephone Federal Surcharge Taxes

144. Telephone State Surcharge Taxes

145. Telephone Local Surcharge Taxes

146. Telephone Minimum Usage Surcharge Tax

147. Telephone Recurring Charges Tax

148. Telephone Non-Recurring Charges Tax

149. Telephone State Usage Charge Tax

150. Telephone Local Usage Charge Tax

151. Tire Recycling Fee

152. Tobacco Tax (Cigar, Pipe, Consumer Tax)

153. Tobacco Tax (Cigar, Pipe, Dealer Tax)

154. Toll Road Tax

155. Toll Bridge Tax

156. Toll Tunnel Tax

157. Tourism or Concession License Fee

158. Traffic Fines (Indirect Taxation)

159. Transportable Treatment Unit Fee (Small Facility)

160. Trailer Registration Tax

161. Trout Stamp (Addendum To Fish License)

162. Use Taxes (On Out-Of-State Purchases)

163. Utility Taxes

164. Unemployment Tax

165. Underground Storage Tank Maintenance Fee

166. Underpayment of Estimated Tax (Form 2210)

167. Unreported Tip Income (Social Security and Medicare Tax)

168. Vehicle License

169. Registration Tax

170. Vehicle Sales Tax

171. Wagering Tax (Tax on Gambling Winnings)

172. Waste Vegetable Oil (WVO) Fuel Tax

173. Water Rights Fee

174. Watercraft Registration Tax

175. Waterfowl Stamp Tax

176. Well Permit Tax

177. Workers Compensation Tax

Filed under: Congress, Democrats, Economy, Government, liberty, May 2009, Republicans, Taxes | Tagged: fair tax, Obamanation, Taxes | 1 Comment »